Preface

Being a treasurer is a really hard job. There is an art and a science and as much as financial services employees are vilified for living well in the high times and handing the tax payers losses in the bad times - I feel for every regional bank treasurer today as they try to calibrate their models.

I spent a large part of my career at as interest rates and fx trader. The topic of liquidity and funding management is one area I can comfortably say I have experience, but if you are here in search of a “point” I’ll apologize in advance - this is very much a public draft of my thoughts.

It is easy and prudent to consider eventualities independently, but it is equally challenging to consider all eventualities at the same time. What could happen if you have deposit flight? What could happen if the portfolio underperforms? It is reasonable to do stress tests for each scenario, but the complexity of managing liquidity when both eventualities occur at the same time and your portfolio is a “risk free” portfolio is a bit of a widowmaker.

Here goes with initial thoughts

Deposits are a financial product

tldr: There seems to be a genie out of the bottle (or emperor with no clothes) event for most people, who will now realize that they took on bank risk for some “benefits” which were not well considered. It could fundamentally change how that product is viewed for most people and likely will create new products for the masses instead of just for the wealthy.

A deposit account is really a contract between an entity and a bank. Cash deposited belongs to the bank, and in return the depositor gets an account, interest and other benefits which they can use to spend the money they handed over to the bank. The depositor owns a special type of interest which, which is a liability of the bank and this interest is NOT money.

Without belaboring this point - this is neither a good thing or a bad thing, it is just a reality and no matter whether the account is called “checking” or “savings,” its purpose is to provide convenience, security and liquidity. In todays world this happens in exchange for lower rates than US Treasury securities and money market funds.

You can tell that deposits are not money or a store of wealth because the banks tell you that when they sell the product. I wont go into how must checking accounts are marketed, but “savings ” accounts are marketed by clearly describing the risks and benefits by comparing “saving” to “investing”

At Wells Fargo:

At US Bank

At TD

TD actually states it clearly - you’re getting a “savings” product, not a place to store your wealth.

Everyone should read the FDIC and Fed Statements

tldr: The Fed saw something at SVB that made them shut down Signature Bank and I think this is a worthy string to be pulled over the next few weeks.

Friday: FDIC creates a new Bank to protect Insured Depositors

The FDIC created a new entity called the Deposit Insurance National Bank of Santa Clara and it moved all of the insured deposits of SVB into that bank ( I’m presuming it will do the same for Signature Bank and I believe this is common) The important thing to note is that there is a difference between insured and uninsured deposits and I believe this distinction is important for reasons I’ll explain laterSunday: The Fed take additional action to fully protect all depositors & The Fed winds down Signature Bank

The Fed essentially says that they are making two “systematic risk exceptions” placing Silicon Valley Bank, Signature Bank in a different framework for FDIC deposit resolution, in order to protect the economy. They also basically say Shareholders and most debtholders will be wiped out.Monday: The Fed presents the solution to the non insured depositors problem: a “Bridge Bank”

I am by no means an expert on the FDIC or banking policy or the savings and loans crisis, but here the Fed created two new banks with two experienced CEO’s to basically run these banks until a sale. The goal here is to protect uninsured depositors and apparently this is not a new thing1

There are so many interesting aspects worthy of discussion, and debate. But the most interesting things about this to me is that

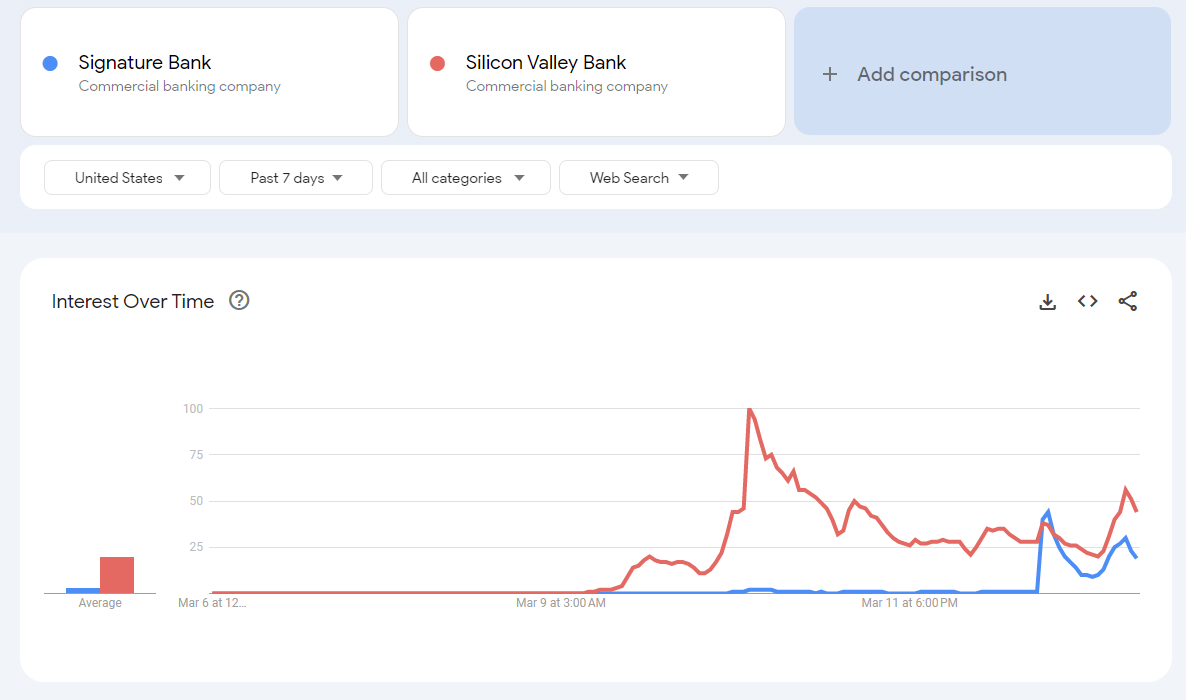

no-one said anything or knew anything about signature bank until AFTER This fed statement: the spike in the blue line below is the statement original release time (I could definitely be wrong here but I didn’t see anything)

There is some trickery which essentially insures all depositors but avoids doing that via the FDIC…

The Fed saw something at SIVB that made them shut down Signature Bank and I think this is a worthy string to be pulled over the next few weeks.

Most entities who have earned wealth behave as though money is not wealth.

tl:dr if the FDIC removes the limitation on insurance we are going into an even MORE murky period where it will be even harder than it is today to differentiate “good” and “bad” banks. Which feels like the opposite of what we all should want.2

Rich people and entities with money already consider the risk of the bank they deposit money with as a part of engaging in the deposit financial product.

Banks are incentivized to have better assets and prove profitability and higher equity to attract deposits and they (used to ) compete by paying higher rates based on their Return on Assets.

An end around FDIC insurance limits basically makes this consideration useless and renders the deposit product to be the same as cash. At which point

why would banks compete to sell this product?

why would a rationale entity not just utilize US Treasuries as store of wealth instead of deposit accounts

Most Banks do not fund lending via Deposits

tl:dr. The systematic risk the Fed is worried about is more about trust in the banking system and not about SVB or any banks actual deposit liabilities. No bank can survive 30% deposit flight, irrespective of how they hedge rates or what assets they own

Whether or not a bank holds assets to maturity or keeps them available for sale, access to cash is a function of the real value of those assets in the repo market.

Holding 100bn of UST’s at book value when they are worth 80bn will not change the fact that cash availability for operations will remain at 80bn less a haircut.

The accounting losses which are being reported as the trigger for the need for raising equity capital don’t make a lot of sense to me. Either they actually defaulted or based on what the FED could see were going to default on a liability, they were turned off in funding markets somewhere or they committed fraud?

Anyway more to come.

Apparently bridge banks, require no capital and the original investors in the former bank supposedly have first dibs at buying equity in the new bridge bank. You learn something new everyday.

It has been well studied that deposits are really not a driver of lending in anyway since most banks can find and utilize non deposit based liabilities. But having no risk in the deposit market probably leads to more volatility not less over time.